Page 48 - CE JOURNAL FEB 2024 ISSUE 20

P. 48

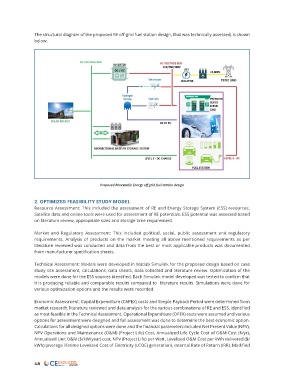

The structural diagram of the proposed RE off-grid fuel station design, that was technically assessed, is shown

below.

Proposed Renewable Energy off grid fuel station design

2. OPTIMIZED FEASIBILITY STUDY MODEL

Resource Assessment: This included the assessment of RE and Energy Storage System (ESS) resources.

Satellite data and online tools were used for assessment of RE potentials. ESS potential was assessed based

on literature review, appropriate sizes and storage time requirement.

Market and Regulatory Assessment: This included political, social, public assessment and regulatory

requirements. Analysis of products on the market meeting all above mentioned requirements as per

literature reviewed was conducted and data from the best or most applicable products was documented

from manufacturer specification sheets.

Technical Assessment: Models were developed in Matlab Simulink for the proposed design based on case

study site assessment, calculations, data sheets, data collected and literature review. Optimization of the

models were done for the ESS sources identified. Each Simulink model developed was tested to confirm that

it is producing reliable and comparable results compared to literature results. Simulations were done for

various optimization options and the results were recorded.

Economic Assessment: Capital Expenditure (CAPEX) costs and Simple Payback Period were determined from

market research, literature reviewed and data analysis for the various combinations of RE and ESS, identified

as most feasible in the Technical Assessment. Operational Expenditure (OPEX) costs were assumed and various

options for assessment were designed and full assessment was done to determine the best economic option.

Calculations for all designed options were done and the financial parameters included Net Present Value (NPV),

NPV Operations and Maintenance (O&M) (Project Life) Cost, Annualized Life Cycle Cost of O&M Cost ($/yr),

Annualized Unit O&M ($/kW/year) cost, NPV (Project Life) per Watt, Levelized O&M Cost per kWh delivered ($/

kWh) (average lifetime Levelized Cost of Electricity (LCOE) generation), Internal Rate of Return (IRR), Modified

48