Page 40 - Annual Report 2017

P. 40

December 31, 2017

(expressed in United States Dollars)

2 Summary of significant accounting polides ... continued

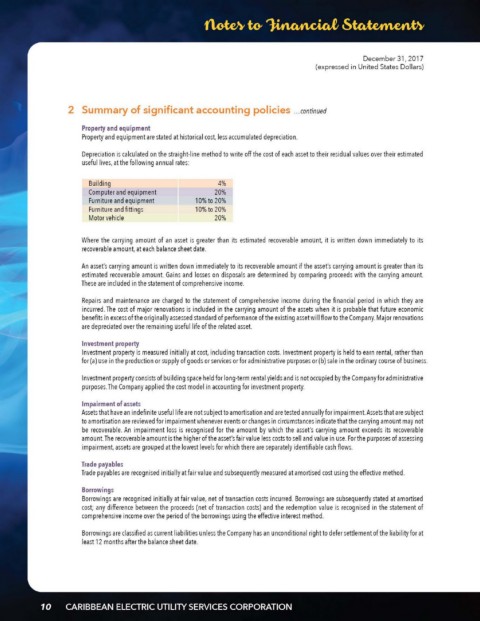

Property and equipmenl

Property and equipment are stated at historical cost, less accumulated depreciation.

D epreciation is calculated on the straight-line method to write off the cost of each asset to their residual values over their estimated

usefullives, at the following annual rates:

Building 4%

Computer and equipment 20%

Furn iture and equipment 10% t020%

Furn iture and fittings 10% t020%

Mator vehicle 20%

Where the carrying amount of an asset is greater than its estimated recoverable am ou nt, it is written down immediately to its

recoverable amount, at each balance sheet date.

An asset's carrying amount is written down immediately to its recoverable am ou nt if the asset's carrying amount is greater than its

estimated recoverable amount. Gains and losses on disposais are determined by comparing proceeds with the ca rrying amount.

These are included in the statement of comprehensive income.

Repairs and maintenance are charged to the statement of comprehensive income du ring the financial period in which they are

incurred. The cost of major renovations is included in the carrying amount of the assets when it is probable that future economic

benefits in excess of the originally assessed standard of perlormance of the existing asset will flow to the Company. Major renovations

are depreciated over the remaining usefullife of the related asset.

Inveslmenl property

Investment pro pert y is measured initially at cost, including transaction costs. Investment property is held to earn rentai, rather than

for (a) use in the production or supply of goods or services or for administrative purposes or{b) sale in the ordinary course of business.

Investment property consists of building space held for long·term rentai yields and is not occupied by the Company for administrative

purposes. The Company applied the cost model in accounting for investment property.

Impairment of assets

Assets that have an indefinite usefullife are not subject to amortisation and are tested annually for impairment. Assets that are subject

to amortisation are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not

be recoverable. An impairment loss is recognised for the amount by which the asset's carrying amount exceeds its recoverable

amount. The recoverable am ou nt is the higher of the asset's fair value less costs to sell and value in use. For the purposes of assessing

impairment, assets are grouped at the lowest levels for which there are separately identifiable cash flows.

Trade payables

Trade payables are recognised initially at fair value and subsequently measured at amortised cost using the effective method.

Borrowings

Borrowings are recognised initially at fair value, net of transaction costs incurred. Borrowings are subsequently stated at amortised

cost; any difference between the proceeds (net of transaction costs) and the redemption value is recognised in the statement of

comprehensive income over the period of the borrowings using the effective interest method.

Borrowings are classified as cu rrent liabilities unless the Company has an unconditional right to defer settlement of the liability for at

least 12 monthsaher the balance sheet date.