Page 44 - Annual Report 2017

P. 44

December 31, 2017

(expressed in United States Dollars)

4 Critical accounting estimates and judgementS continued

Use of estimates

The key assumptions concerning the future and other key sources of estimation uncertainty at the balance sheet date, that have

significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within the next financial year are

discussed below.

(a) Provision for impairment of receivables and investment in securities: loans and receivables

TIhe Company maintains a provision for impairment of receivables at a level considered adequate to provide for potentially

uncollectible receivables. The level of provision is evaluated by management based on experience and other factors that may

affect the recoverability of these assets. If there is an objective evidence that an impairment loss on reeeivables carried at

amortised cast has been incurred, the amount of the loss is measured as the differenee between the asset's carrying amount and

the present value of estimated future cash flows (excluding future credit losses that have not been incurred) discounted at the

financial asset's original effective interest rate. The carrying amount of the asset shall be reduced either directly or through use

of an allowance accounts. The amount and timing of recarded expenses for any period would therefore differ based on the

judgements or estimates made. An increase in provision for impairment of reeeivables and investment securities would increase

the Company's recarded expenses and decrease current assets.

(i) Provision for impairment of receivables net of provisions written back amounted ta $12,000 (2016 -$9,745). Receivables

which were written-off from receivables amounted ta $8,513 (2016 -$5,249). Receivables, net of provision for impairment

of receivables, amounted ta $203,461 (2016 -$89,504).

(ii) Provision for impairment of investment securities: loans and receivables was $Nil (2016 - $Nil). Investment securities:

loans and receivables, net of provision for impairment on investment securities: loans and reeeivables, was $1,201,487

(2016 -$1, 180,503)(Note 7).

(b) Fair value measurement

Management uses valuation techniques ta determine the fair value of financial instruments (where active market quotes are not

available) and non·financial assets. This involves developing estimates and assumptions consistent with how market

participants would priee the instrument. Management bases its assumptions on observable data as far as possible but this is not

always available. In that case management uses the best information available. Estimated fair values may vary from the actual

priees that would be achieved in an arm's length transaction at the reporting date (see Note 7).

(e) Estimated usefullives

The useful life of each of the Company's property and equipment is estimated based on the period over which the asset is

expected ta be available for use. Such estimation is based on a collective assessment of industry practice, internai technical

evaluation and experienee with similar assets. The estimated usefullife of each asset is reviewed periodically and updated if

expectations differ from previous estimates due ta physical wear and tear, or other limits on the use of the asset.lt is possible,

however, that future results of operations could be materially affected by changes in the amounts and timing of recorded

expenses brought about by changes in the fadors menlioned above. A reduction in the estimated usefullife of any property and

equipment wou Id increase the recorded depreciation expense and decrease non·current assets.

(d) Assetimpairment

IFRS requires that an impairment review be performed when certain impairment indicators are present. ln purchase accounting,

estimation and judgement are used in the allocation of the purchase price to the fair market values of the assets purchases and

liabilities assumed. Likewise, determining fair value of assets requires the estimation of cash flows expected to be generated

from the continued use of the ultimate disposition of such assets.

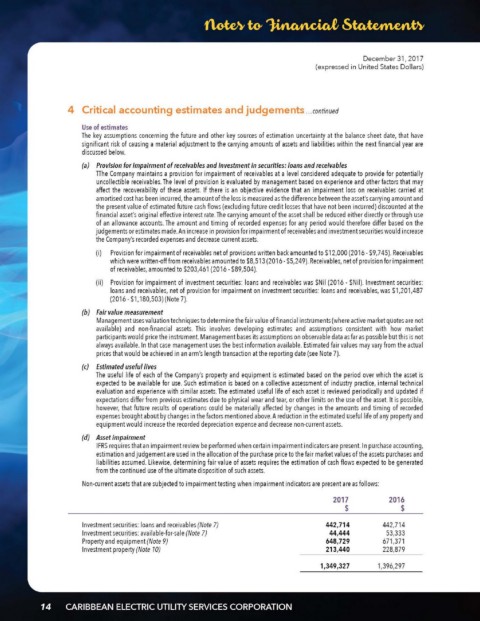

Non-cu rrent assets that are subjected to impairment testing when impairment indicators are present are as follows:

2017 2016

$ $

Investment securities: loans and reeeivables (Note 7) 442,714 442,714

Investment securities: available-for·sale (Note 7) 44,444 53,333

Property and equipment (Note 9) 648,729 671,371

Inveslmenl property (Note 10) 213,440 228,879

1,349,327 1,396,297