Page 45 - Annual Report 2017

P. 45

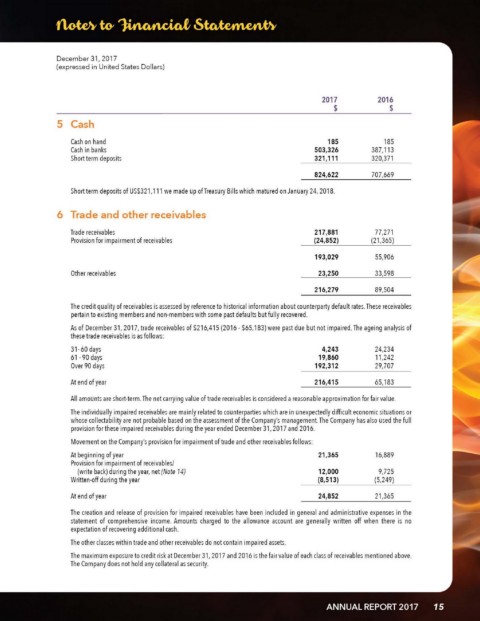

December 31, 2017

(expressed in United States Dollars)

2017 2016

$ $

5 Cash

Cash on hand 185 185

Cash in banks 503,326 387,113

Short term deposits 321,111 320,371

824,622 707,669

Short term deposits of US$321 , 111 we made up oflreasury Bills which matured on January 24, 2018.

6 Trade and other receivables

Trade receivables 217,881 77,271

Provision for impairment of receivables (24,852) (21,365)

193,029 55,906

Other receivables 23,250 33,598

216,279 89,504

The credit quality of receivables is assessed by reference to historical information about cQunterparty default rates. These receivables

pertain to existing members and non-members with sorne pa st defaults but fully recovered.

As of Decomber 31, 2017, trade receivables of $216,415 (2016 · $65,183)were pa st due but not impaired. The ageing analysis of

these trade receivables is as follows:

31- 60 days 4,243 24,234

61 -90 days 19,860 11,242

Over 90 days 192,312 29,707

At end of year 216,415 65,183

Ali amounts are short-term. The net carrying value of trade receivables is considered a reasonable approximation for fair value.

The individually impaired receivables are mainly related to counterparties which are in unexpectedly difficult economic situations or

whose collectability are not probable based on the assessment of the Company's management. The Company has also used the full

provision for these impaired receivables during the year ended December 31, 2017 and 2016.

Movement on the Company's provision for impairment of trade and other receivables follows:

At beginning of year 21 ,365 16,889

Provision for impairment of receivablesl

(write bock) during the year, net (Note 14) 12,000 9,725

Written-off during the year (8,51 3) (5,249)

At end of year 24,852 21,365

The creation and release of provision for impaired receivables have been included in general and administrative expenses in the

statement of comprehensive income. Amounts charged to the allowance account are generally written off when there is no

expectation of recovering additional cash.

The other classes within trade and other receivables do not contain impaired assets.

The maximum exposure to credit risk at December 31, 2017 and 2016 is the fair value of each class of receivables mentioned above.

The Company does not hold any collateral as security.