Page 42 - Annual Report 2017

P. 42

December 31, 2017

(expressed in United States Dollars)

3 Financial risk management

The Company's activities expose it to a variety of financÎal risk: market risk (foreign exchange risk and priee risk), credit risk, interest

rat, risk, and liquidity risk.

Market risk analysis

The Company's activities is exposed to market risk through its use of financÎal instruments and specifically to currency risk and certain

other priee risks, which result trom both its operating and investing activities.

Foreign exchange fisk

T he Company trades internationally. Such transactions are primarily in US$ and EC$. The exchange rate of the Eastern Caribbean

dollar (EC$) to th, US$ has b"n formally p'gg,d at EC$2.70 ~ US$1.00 sin" July 1976. Manag,m,nt does not b,li,v, that

significant foreign exchange risk exists at December 31, 2017.

Interest rate risk

As the Company has interest-bearing assets primarily pertaining to investments maturing within one year, the Company's income and

operating cash-flows are exposed to changes in interest rates.

The Company's interest rate risk arises fram long·term borrowings issued at fixed rates. The Company's exposure and interest rates on

its financial assets and liabilities are disclosed in Notes 7 and 12.

Priee risk

The Company is exposed to equity securities price risk because of investments held by the Company and classified on the balance

sheet as available·for-sale. Investments in equity securities are publicly traded. Management does not believe that significant price

risk exists at Dec,mber 31, 2017.

Credit risk

Credit risk arises fram cash in banks, investment securities, and deposits with banks and financial institutions, as weil as credit

exposures to members and non-members, including outstanding receivables and committed transactions. The Company also

performs periodic credit evaluations of its members and affiliates' financial condition.

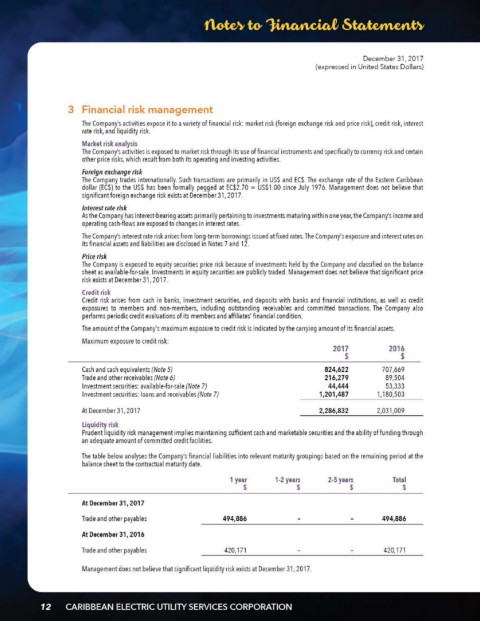

The amount of the Company's maximum exposure to credit risk is indicated by the carryi ng amount of its financia l assets.

Maximum exposure to credit risk:

2017 2016

$ $

Cash and cash 'quival,nts (Note 5) 824,622 707,669

Trad, and other rec,ivables (Note 6) 216,279 89,504

Investment securities: available-for·sale (Note 7) 44,444 53,333

lnvestment securities: loans and receivables (Note 7) 1,201,487 1,180,503

At Dec,mber 31,2017 2,286,832 2,031,009

Liquidity risk

Prudent liquidity risk management implies maintaining sufficient cash and marketable securities and the ability of funding through

an adequate am ou nt of commitled credit facilities.

The table below analyses the Company's financia lliabilities into relevant maturity graupings based on the remaining period at the

balance sheet to the contractual maturity date.

1 year 1-2 years 2-5 years Total

$ $ $ $

At Oecember 31,2017

Trad, and other payables 494,886 494,886

At Oecember 31,2016

Trad, and other payables 420,171 420,171

Management does not believe that significant liquidity risk exists at December 31, 2017.