Page 48 - Annual Report 2017

P. 48

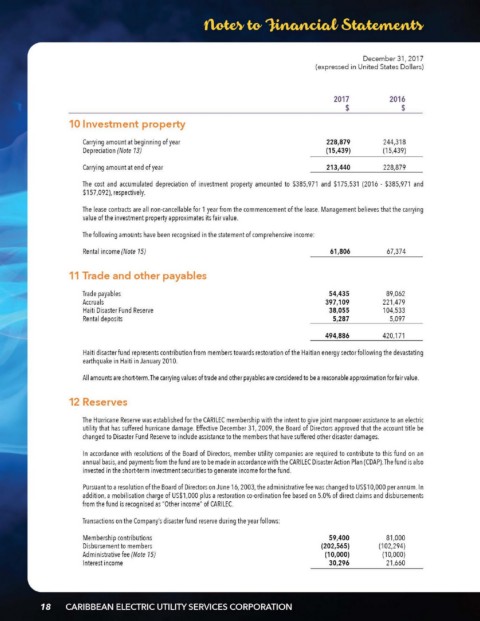

December 31, 2017

(expressed in United States Dollars)

2017 2016

$ $

10 Investment property

Carryi ng amount at beginning of year 228,879 244,318

Depreciation (Note 13) (15,439) (15,439)

Carryi ng amount at end of year 213,440 228,879

The cost and accumulated depreciation of investment property amounted to S385,971 and S175,531 (2016 - S385,971 and

S157,092), respectively.

The lease contracts are ail non-cancellable for 1 year trom the commencement of the lease. Management believes that the ca rryi ng

value of the investment property approximates its fair value.

The following amounts have been recognised in the statement of comprehensive income:

Rentai income (Note 15) 61 ,806 67,374

11 Trade and other payables

Trade payables 54,435 89,062

Accruals 397,109 221,479

Haiti Disaster Fund Reserve 38,055 104,533

Rentai deposits 5,287 5,097

494,886 420,171

Haiti disaster fund represents contribution trom members towards restoration of the Haitian energy sector following the devastating

earthquake in Haiti in January 2010.

Ali amounts are short-term. The carrying values of trade and other payables are considered to be a reasonable approximation forfair value.

12 Reserves

The Hurricane Reserve was established for the CARILEC membership with the intent to give joint man power assistance to an electric

utility that has suffered hurricane damage. Effective December 31, 2009, the Board of Directors approved that the account title be

changed to Disaster Fund Reserve to include assistance to the members that have suffered other disaster damages.

ln accordance with resolutions of the Board of Directors, member utility companies are required to contribute to this fund on an

annual basis, and payments from the fund are to be made in accordance with the CARllEC Dimter Action Plan (CDAP). The fund is also

invested in the short·term investment securities to generate income for the fund.

Pursuant to a resolution of the Board of Directors on June 16, 2003, the administrativefee was changed to USS10,000 per annum. ln

addition, a mobilisation charge of US$1 ,000 plus a restoration co-ordination fee based on 5.0% of direct claims and disbursements

from the fund is recognised as "Other income" of CARllEC.

Transactions on the Company's disaster fund reserve du ring the year follows:

Membership contributions 59,400 81,000

Disbursement to members (202,565) (102,294)

Administrative fee (Note 15) (10,000) (10,000)

Interest income 30,296 21,660