Page 38 - CARILEC Electricity Tariff - December 2014

P. 38

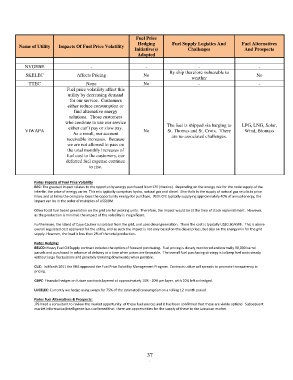

Fuel Price

Hedging Fuel Supply Logistics And Fuel Alternatives

Name of Utility Impacts Of Fuel Price Volatility

Initiative(s) Challenges And Prospects

Adopted

NVGEBE - - - -

By ship therefore vulnerable to

SKELEC Affects Pricing No No

weather

TTEC None No - -

Fuel price volatility affect this

utility by decreasing demand

for our service. Customers

either reduce consumption or

find alternative energy

solutions. Those customers

who continue to use our service

The fuel is shipped via barging to LPG, LNG, Solar,

either can’t pay or slow pay.

VIWAPA No St. Thomas and St. Croix. There Wind, Biomass

As a result, our account are no associated challenges.

receivable increases. Because

we are not allowed to pass on

the total monthly increases of

fuel cost to the customers, our

deferred fuel expense continue

to rise.

Notes Impacts of Fuel Price Volatility

BEC: The greatest impact relates to the opportunity energy purchased from CFE (Mexico). Depending on the energy mix for the node supply of the

intertie, the price of energy varies. This mix typically comprises hydro, natural gas and diesel. Shortfalls in the supply of natural gas results in price

hikes and at times the company loses the opportunity energy for purchase. With CFE typically supplying approximately 40% of annual energy, the

impact can be in the order of multiples of US$10M.

Other fossil fuel based generation on the grid are for peaking units. Therefore, the impact would be at the time of stock replenishment. However,

as the production is minimal, the impact of the volatility is insignificant.

Furthermore, the island of Caye Caulker is isolated from the grid, and uses diesel generation. There the cost is typically US$0.30/kWh. This is above

overall regulated cost approved for the utility, and as such the impact is not only based on the diesel prices, but also on the energy mix for the grid

supply. However, the load is less than 2% of the total production.

Notes Hedging:

BELCO: Heavy Fuel Oil Supply contract includes the option of forward purchasing. Fuel pricing is closely monitored and normally 30,000 barrel

parcels and purchased in advance of delivery at a time when prices are favorable. The overall fuel purchasing strategy is to keep fuel costs steady

without large fluctuations and generally trending downwards when possible.

CUC: In March 2011 the ERA approved the Fuel Price Volatility Management Program. Contracts utilize call spreads to promote transparency in

pricing.

GBPC: Financial hedges on future contracts layered at approximately 10% - 20% per layer, with 10% left unhedged.

LUCELEC: Currently we hedge using swaps for 75% of the estimated consumption on a rolling 12 month period

Notes Fuel Alternatives & Prospects:

JPS hired a consultant to review the market opportunity of these fuel sources and it has been confirmed that these are viable options. Subsequent

market information/intelligence has confirmed that there are opportunities for the supply of these to the Jamaican market

37

.